In the fast-paced world, exploring side income options has become imperative. The stock market provides an ideal choice for creating such an income source. Unlike in the recent past, the development of online platforms made it easy to access this marketplace. However, the stock market is notorious for making people lose money, primarily because of a lack of understanding. A successful career in the stock market requires an in-depth knowledge of multifaceted aspects like types of shares, the history of the share price, economic events, taxation policies of a country, and many more. This article focuses on the in-depth understanding of types of shares.

What are Shares?

A share is a basic unit of ownership in a company, just like atoms are a building block of matter. The percentage of shares a person owns determines the rate of ownership in a company. According to Investopedia, the largest individual shareholder of Apple is Arthur Levinson, who owns 4,590,576 shares, meaning he has the most significant individual ownership in Apple.

Understanding the Difference between Stocks and Shares

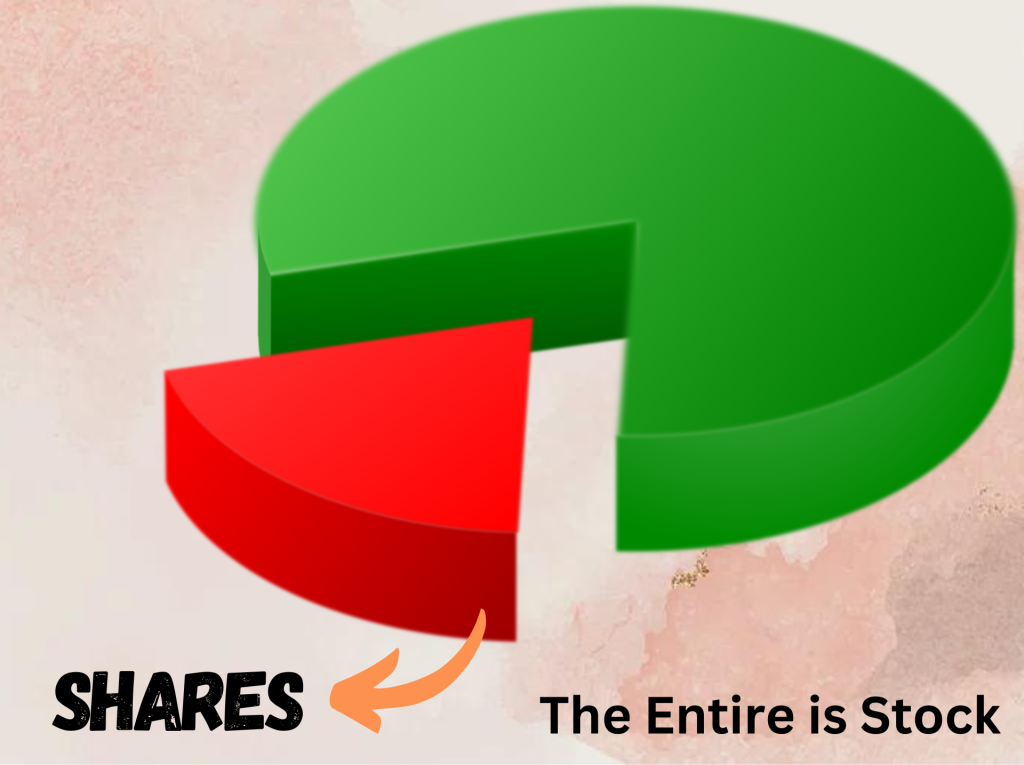

Stocks and shares are used interchangeably; however, there is a subtle difference between them. The stock term has a broader connotation, while the share is narrower. Shares are the basic ownership units, meaning they are the lowest denomination of stock. However, stock represents the entire sum of all the shares. To illustrate this with an example, Apple’s market cap on 19 July 2024 was 3.436 trillion USD, and the value of individual shares was 224.38 USD. Hence, a stock is a whole pie, and a share is a piece of that pie.

Types of Shares

Shares are broadly categorised into three main types considering the limitations/ terms and conditions offered and how shares earn profit for the shareholder.

Ordinary Shares

These are the ordinary shares a company offers to the public. Equity shares and common shares are the terms used interchangeably. Generally, this type comes with voting rights and offers no particular dividends. Equity shares are openly traded in the stock market because they are easily transferable. The exciting features of ordinary shares are easy access to common people and low capital investment.

Preference Shares

Like equity shares, preference also gives ownership in a company but comes up with some conditions. As the name suggests, these offer preferential rights to the shareholders. Although preference shares do not allow the shareholders voting rights, they enable the shareholders to have fixed or cumulative dividends on priority over ordinary shareholders. Preference shareholders get preferential receiving when a company liquidates. They require high capital investment.

Preference shares are further subcategorised according to the treatment they get towards the end of a predetermined term.

a. Redeemable Preference Shares

Redeemable preference shares enable a company to buy back the preference shares at a set price after the expiry of a predetermined term. These shares provide flexibility for a company in capital structuring in the first place and simultaneously grant the right to buy back the shares at a predetermined price after a certain period, saving the company’s crucial ownership.

b. Convertible Preference Shares

These are the most flexible shares a company offers to an investor. A convertible preference shareholder can enjoy aspects of both ordinary shares and preference shares. These shares provide an option to be converted to ordinary shares at a predetermined price at a set time.

c. Cumulative Preference Shares

Most companies do not pay dividends regularly. If dividends are not paid for a particular financial year, ordinary shareholders cannot claim dividends in the future. However, cumulative preference shares enable shareholders to get unpaid dividends before any dividend is paid to the ordinary shareholder.

d. Participating Preference Shares

When companies perform outstandingly, they get surplus capital after paying due dividends to their shareholders. The extra capital is distributed among the participating shareholders on a predetermined condition. Hence, a participating shareholder gets its regular dividend with additional dividends.

Choosing the Right Shares

Choosing the right shares is a linchpin in stock market success. It depends on the aim of the investor.

For long-term capital appreciation

Ordinary shares are undoubtedly most suitable for long-term capital appreciation. They can be transferred easily and hence traded anytime. They also enable shareholders to have voting rights and sometimes dividends.

For stable income

Preference shares are a good option for stable and continuous income. As they come with preferential treatment over ordinary shares. However, limited availability and a high capital investment impedes buying preference shares.

For seeking flexibility

Convertible shares are the best option for investors seeking flexibility. They offer capital appreciation in the long term and stable income until a certain time. If someone can avail themselves of such shares, he should consider buying them.

Bottom Line

A successful career in the stock market requires in-depth knowledge of many factors. Understanding the types of shares is the basic one to start. Types of shares depend on the terms and conditions they come up with and how they pay back the shareholders. The two basic types are ordinary shares and preference shares. Ordinary shares enable a person to have voting rights in decision-making; they are easy to trade and provide a good option for long-term capital appreciation. Whereas preference shares enjoy preferential treatment over ordinary shares, they provide a good option for continuous income. Lastly, convertible shares are the most flexible and offer aspects of ordinary and preference shares.