Learning technical analysis is all about studying charts and using various indicators to identify trends, support and resistance levels, and potential entry and exit points. By analyzing technical data, traders can make correct decisions about buying and selling currencies. Developing sound technical analysis skills is crucial to navigate the investment markets successfully.

To become a successful trader, utilizing both technical and fundamental analysis is essential. Technical analysis involves analyzing historical market data through price charts to predict future price trajectories accurately. By understanding market trends, one can increase his/her chances of making profitable trades. It’s a valuable tool to help you make diligent decisions and achieve your trading goals.

How to invest in cryptos in 2024? Learn here…

Why is it Important to Learn Technical Analysis?

Technical analysis plays a crucial role when one is interested in the forex market/ share market. Analyzing market behavior in the past can provide insights and predictions for future trends. By understanding the patterns and indicators, investors can decide when to enter and exit trades, ultimately leading to profits. Technical analysis helps investors identify the correct entry and exit points to optimize their returns. Therefore, it is essential to learn technical analysis to make informed investment decisions and maximize profits. However, there are some misconceptions about Technical Analysis, which are debunked here.

How to survive inflation? Read here…

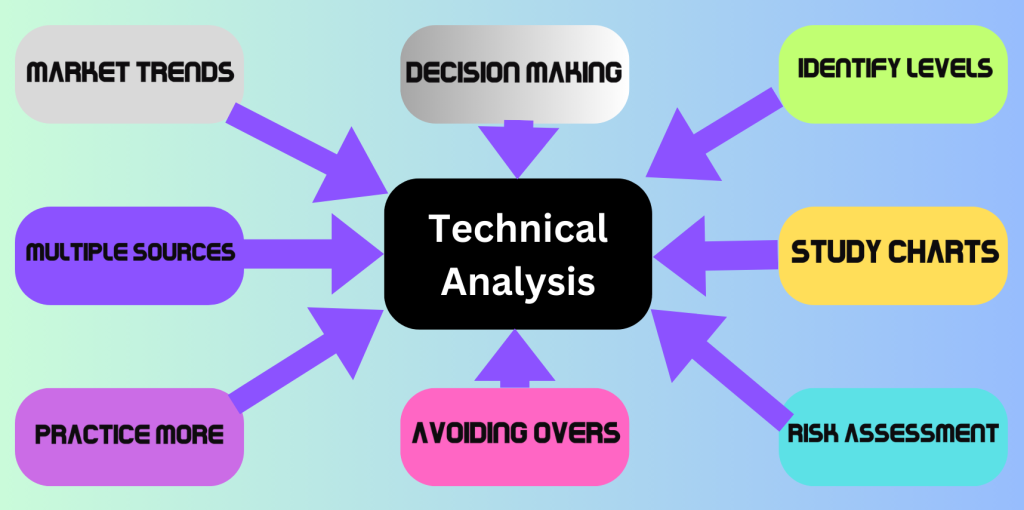

You must follow eight steps to learn and improve your Technical Analysis.

1. Develop the Ability of Quick thinking and Decision Making

If you are interested in day trading or scalping, developing your ability to think quickly and confidently make decisions is essential. Technical analysis plays an important role in these types of trading, but you won’t have much time to analyse a plethora of data before making a move. To enhance your quick thinking and decision-making skills, consider doing some exercises recommended by experts. These include meditation, playing a sport, or even a computer game. By honing these abilities, you’ll be better equipped to take advantage of good trade opportunities that come your way.

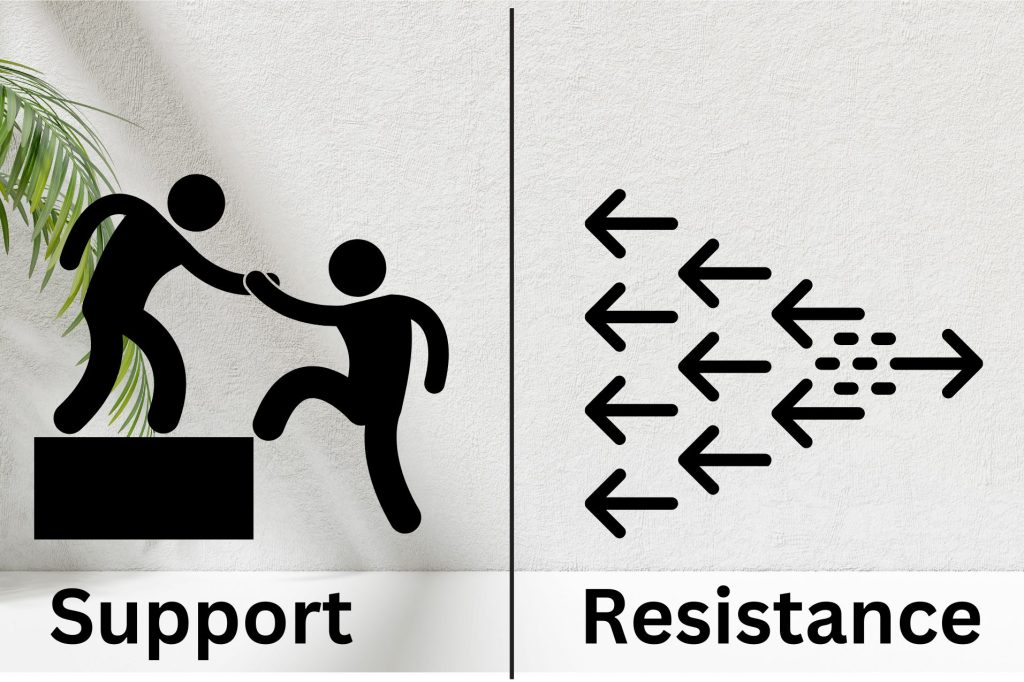

2. Identify Support and Resistance Areas

Identifying resistance and support levels is inarguably the most essential aspect of trading. Resistance is a level where, theoretically, traders stop buying and start selling, whereas support is a level where traders stop selling and start buying. Support provides an ideal entry for buying, and resistance offers a perfect entry for selling. Identifying resistance and support provides excellent opportunities for making entries. While assessing resistance and support levels, one should keep fundamental analysis in mind. Generally, on ordinary days, the market does not cross these levels; however, any significant change in fundamental aspects can push or pull the market so much that it easily crosses these levels. So, always corroborate your technical analysis outcome with your fundamental analysis.

Learn financial literacy here…

3. Look for Broader Market Trends

One crucial aspect to keep in mind while using trading platforms is the availability of charting features in multiple timeframes. These timeframes can range from as low as 1 minute to as high as daily or weekly. If you want to perform accurate technical analysis, looking at broader market trends is recommended. Focusing only on hourly charts is not enough if you are a day trader. Instead, you should also pay attention to the 4-hourly and daily charts for a more comprehensive view of the market trends. This will help you make better trading decisions.

Which were the best performing cryptocurrencies of 2023.

4. Must Consult All Types of Charts Available

For a trader, understanding the different types of charts used in forex trading is crucial. The three main types of charts are line, bar, and candlestick charts. Each chart offers a unique perspective and specific information about the market trends. The line chart helps understand the broader market trends by removing the noise in the data. On the other hand, bar and candlestick charts provide more detailed information about the market trends and a closer look into the data. To make informed trading decisions, traders should consult all available charts for technical analysis. This will help them to get a comprehensive view of the market trends and make better trading decisions.

How do people achieve financial freedom??

5. Consult Other Sources of Learning

Plenty of platforms are available for trading aspirants to improve their technical skills. Reading a couple of books about this topic will help you a lot. “Technical Analysis Explained” by Martin J. Pring is considered the Bible of technical analysis, and “Encyclopedia of Chart Patterns” by Thomas N. Bulkowski is a highly rated technical analysis book. Books are a top priority, but if you do not find enough time to read those books, you can consult online forums where you can learn from experienced traders. Moreover, you can also consider joining an online course by a reputable institute.

6. Assign A Target, Balance Risk Reward Mechanism

Trading will only be fruitful if you have a precise aim in mind; all your trading activities should revolve around your target. An aimless trader always makes losses, and one should be very clear about the starting and ending of his trade. Assigning yourself a target will focus your efforts, removing all unnecessary factors. One trades for a reward; a reward comes with risk, so one should be clear about how much and how long he can take a risk.

A detailed guide for crypto investments

7. Overdoing and Overthinking Decreases Efficiency

There is an inverse relation between overdoing/overthinking and your decision-making. All the efforts are for improving your decision-making; however, overdoing technical analysis may hinder your ability to make a decision. Many other factors are involved in technical analysis, and focusing on them with the same intensity is impossible for a trader. Moreover, not all the factors involved in technical analysis need to converge at a single point, traders have to balance out these factors and give importance to other crucial factors. Keep your chart clear. Only add those factors that have been suitable for you in the past, and focus only on those aspects.

How individual’s psychology impacts trading?

8. Practice More

When we talk about “improvement” in the context of trading, we mean increasing your skills, knowledge, and experience. To become a successful trader, it’s essential to have a solid foundation of technical and fundamental analysis and a good understanding of market dynamics and psychology. However, knowing alone is not enough. Practicing what you’ve learned repeatedly to consolidate it and develop your skills would be best.

Steps to follow before starting forex trading

By practicing your technique on demo accounts, you can gain real-life experience and learn from your mistakes without risking actual money. Repeating your practice multiple times will help you identify your weak points and areas for improvement. Once you’ve identified your mistakes, you can work on overcoming them and practicing again until you’ve mastered the skill.

Bottom Line

Technical analysis involves studying charts and using various indicators to identify trends, support and resistance levels, and potential entry and exit points. By analyzing technical data, traders can make the right decisions about buying or selling national currencies. Developing good technical analysis skills is crucial to navigate the forex market successfully. To learn technical analysis skills, traders must study from multiple sources, including books, online resources, and trading courses. They should also devise a trading strategy that suits their goals and risk tolerance and practice it multiple times to gain experience and confidence.

[…] Learn technical analysis skills for forex trading… […]

[…] Related: How to learn technical analysis skills […]

[…] Related: How to learn technical analysis? […]

[…] factors of technical analysis include optimal use of indicators like Bollinger Bands, Parabolic SAR (Stop and Reverse), MA […]

jcpviKLlaM

[…] will not discuss technical and fundamental analysis. Instead, we will discuss the steps before starting forex trading. Forex […]

[…] which are dreadful for successful trading. Keeping personal biases aside, objective analysis of technical and fundamental aspects is the linchpin of success or failure. Wrong risk management, fear of […]

[…] Technical analysis is the core of automated forex trading platforms; they are programmed to effectively implement it and run trades automatically. The other important aspect is the effective integration of fundamental analysis into the platform. An efficient automated trading platform must be programmed to look for the fundamentals of a currency pair or a commodity. The fundamentals include company trade reports, economic indicators (like GDP, inflation rates, and interest rates), geopolitical events, and even social media sentiment. […]