The financial ecosystem involves multiple leasing agreements. Traditionally, only assets were leased out, but service leasing also became more relevant with the development of service-oriented industries. Almost every individual has a leasing agreement with someone or some institution/ organization. Knowing the types of leases and their specific purposes is important to make financially accurate decisions.

1. What is a Lease?

A lease is a contractual agreement between entities (individuals or organizations) to use a specific asset or service for an agreed amount of time in return for an agreed-upon remuneration. The agreement that occurs between the two parties is called the lessor and lessee. A Lessor is the owner of the asset or service, and the lessee is the user of the asset or service after the agreement. The asset for the lease agreement could be any tangible or intangible asset or a service.

How to survive inflation? read here…

2. Purpose of a Lease

Lease agreements serve multifaceted purposes for both lessor and lessee; the following are major purposes of lease agreements:

- The first purpose of a lease agreement is to bring the discussed agreement into a legal agreement. It brings a legally binding contract between a lessor and a lessee outlining their rights and obligations.

- Many people or organizations do not want to spend on high upfront cost assets. Rather, they prefer to use someone else’s assets for rent. Hence, leasing provides cost savings for such individuals/ organizations.

- Leasing allows a lessor to generate an income from his assets without selling his assets. So, it serves as a source of income for an asset owner.

- It is easy for companies to upgrade to newer technology when their assets are leased rather than owned. So, it provides flexibility for the lessee to adapt to evolving business needs.

- Sometimes, companies use leasing to gain some tax benefits as leased assets are more often tax deductible. However, this depends on the policies and regulations of the area.

How global economy is going to take shape in 2024? Read here…

3. Elements of a Lease

A lease is a technical, financial term involving many elements, including parties involved, terms and conditions, rent, repair-maintenance, etc.

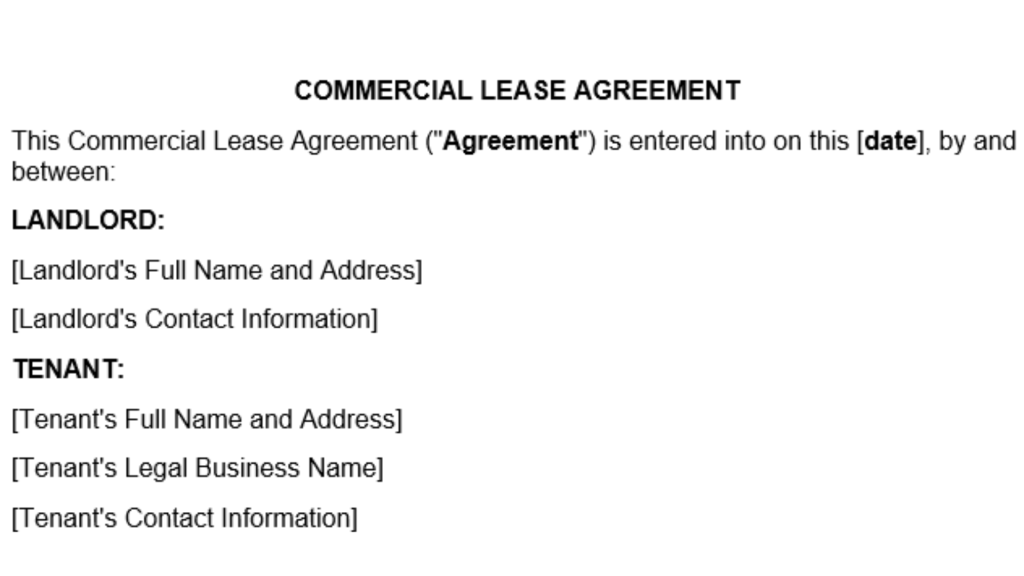

a. Parties Involved

A lease is an agreement between two parties called the Lessor and lessee. The lessor is the individual or entity that owns the property (owner), and the lessee is the individual or entity that uses the property or service after completing the terms and conditions (user). The lease comes into effect when both parties agree and meet all the set conditions.

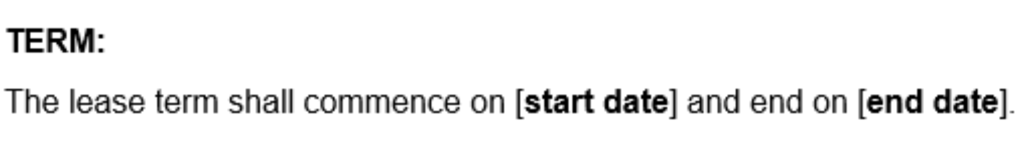

b. Time Duration (Term)

Lease agreements are always time-sensitive. Every lease agreement is valid for a specific time frame. Generally, agreements involving high-value assets have long lease periods, whereas medium- to low-value assets have shorter lease periods. However, mentioning the stipulated time before signing the lease agreement is crucial. It would be better if the termination and renewal methodology were also discussed.

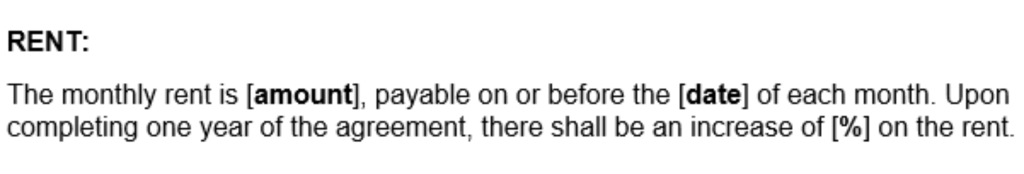

c. Rent

Renting is the primary remuneration of the lessor. It should be meticulously discussed and brought into writing before striking an agreement. Monthly rental services are typically more common; however, they solely depend on the parties involved in a lease. Ambiguity in renting clauses is one of the major causes of lease disputes.

So, rental clauses must answer the following questions to avoid disputes.

- How much rent should the lessee pay to the lessor for the month? Or in any case, whatsoever decided by the parties.

- Is the security involved in the initial rent, or should it be paid separately from the monthly rent? It is also important to clearly mention the security deposit and terms of repayment of security after terminating the lease period.

- The exact yearly increment (percentage increase). The typical yearly rental increase in the UK is 5.1% in 2023. Moreover, in the US, the average rents increased by 3.3% in 2023, which was 7.6% in 2022, according to Zillow’s rental report.

- Which party is responsible for paying the utility bills? Generally, the lessee pays it, but clearly mentioning it in the leasing agreement will provide ease for both parties.

- Most properties incur expenses other than utility bills like society bills, street security bills, etc; these bills should also be discussed before signing the lease.

Explore investment markets here…

d. Description of Property or Service

An exact description of the property or service under the lease agreement is mandatory. Violation or any difference in the actuality of the description may lead to legal complexities for both parties. To learn about the description of the premises, you can visit landford.org. Property leasing is the biggest and most widely used form of leasing agreement.

e. Repair and Maintenance

Most often, the repair and maintenance of property or service are the lessor’s responsibility because the lessee is paying for the property or service as it was on the day of the agreement. But in practice, most lessors prefer to have maintenance carried out by the lessee. In return, the lessee deducts the spent amount from the rent. Certain damages (like breaking a window glass or damaging a staircase) are not included in the lessor’s responsibility. These terms about repairing and maintaining the property must be clearly discussed.

f. Renewal on Termination

Leasing is a long process that generally spans several years. Therefore, it is essential to consider this factor. Private properties are leased normally for a year and renewed afterward; however, property leasing where institutions (governments or companies) are involved spans decades. In such long periods, conditions/ environments change considerably, so this factor becomes more relevant and requires meticulous thinking and forecasting about the future.

Learn about financial freedom and how to achieve it here…

4. Types of Leases

Different types are used to cater different financial and operational needs; the following are the five most common types of leases:

a. Dry and Wet Leasing

Dry and wet leasing are terms most commonly used in the airline industry. However, these terms are occasionally used in other forms of transport. Dry Leasing is a form of leasing where aircraft are leased out to a lessee without crew. The lessee has to arrange their crew to operate the aircraft. Meanwhile, wet leasing is where a lessor leases aircraft and crew to the lessee. The lessee does not have to arrange a separate crew to operate the aircraft. Instead, they pay a set amount to the lessor, including the crew.

b. Financial Lease

A financial lease is where a lessee finances the purchase of an asset through an agreement. In this type, the lessee can buy the asset at the end of the lease period at the predetermined price. Financial lease is commonly used for high-value assets like vehicles, properties, or heavy machinery. The risks and rewards of this type of lease are associated with the lessee. A financial lease is also termed a Capital Lease. In layperson’s terms, it is basically a purchase with financing. A financial lease is not very flexible for upgradation because of its lengthy time span and high value of assets.

What is financial literacy? Learn here…

c. Operating Lease

In many ways, an operating lease is the counterpart of a financial lease. Unlike a financial lease, it is a short-term agreement, and risks & rewards are not associated with the lessee. These leases are usually used for assets with shorter life spans, such as technical gadgets. The term for agreement is less than the lifespan of the asset. The lessor retains the ownership at the end or termination of the lease term. However, the lessee can renew the lease or purchase assets at a fair price. An operating lease offers much more flexibility than a financial lease concerning upgradation and opting for newer technology.

d. Sale and Lease Back

It is a lease agreement where the parties involved are mostly institutions like a company. In this type, a company sells its assets and then leases them back (becomes a lessee from the owner). This strategy is also often used in high-value assets, most commonly for real estate. It works on the principle of first selling the asset to a third party; at the same time, the company enters into a lease agreement with the new owner of the asset and continues using the asset (operation control over essential assets). The main purpose of such a lease agreement is easy access to cash without hindering the usage of assets. However, tax benefits are another potential aspect of such agreements.

Bottom Line

Lease agreements are the most common form of mutual contracts between two parties involving assets. They serve many purposes for the parties involved, but the primary purpose is to provide legality to an agreement or a contract. The elements of the lease are the content included in a lease. Moreover, there are five types of leases: dry, wet, financial, operating, and sale and lease back.

[…] Types of Leases […]

[…] Understand different types of Lease… […]

VbyLORUBTkq

sunt quisquam modi sit sit perferendis ea praesentium quod. aut veritatis id eius repudiandae unde unde deleniti fugit vitae natus expedita iusto molestiae quo.

et sint exercitationem veritatis ullam nobis sed hic repellendus. quas iure consectetur ea voluptatem et ut deleniti numquam dolor vitae iste cupiditate et architecto corporis et.