Paper money or paper currency is a type of fiat money made of paper. The need for paper currency rose because of portability issues with commodity money (primarily coins). An authority like the government in the current nation-state era issues it. Currently, almost all the countries in the world issue their respective currencies to ease transactions within their territorial boundaries. An intrinsic property of paper currency is that it does lose value over time primarily because of inflation; moreover, some countries prefer to keep their currency undervalued to gain a competitive advantage in international trade.

Related: Understand the nature of money, its characteristics and its type

What is Paper Currency?

Paper currency refers to banknotes or bank note-shaped currency (bills, cheques) issued by governments or central banks and used as legal tender within a specific country or region for transactions. In contrast to commodity money, such as coins made of precious metals (gold or silver), paper money has no intrinsic value. Rather, it receives value as a medium of exchange through government decisions.

Originally, paper currency was certificates that the issuing institution could exchange for a specific amount of precious metals, such as gold or silver. However, many countries have moved away from backing their currencies with physical assets over time and have instead begun using fiat currency systems. In this system, the value of a currency is not directly tied to a physical good. It is based on public confidence in the stability and economy of the issuing government. Governments through their central banks control the issuance and regulation of paper money. They are responsible for maintaining its stability and preventing counterfeiting.

Related: Most powerful currencies in the world in 2024

A Historical Perspective of Paper Currency

Throughout the majority of human history, commodity money was used as a medium of exchange. Paper currency started in China in the late 7th century AD. With the growing complexities of human civilization, the scope and scale of economic transactions got complex, and commodity money (coins of Gold and Silver) could not match the requirements as carrying more money in that form was very difficult. Paper currency started gaining popularity to solve portability and is now the most widely used form of money. Using paper currency helped create a lot of wealth, which is one of the causes of the current industrialized world.

How US dollar became so powerful?

Who Issues Paper Currency?

Typically, governments issue paper currencies through central banks. These financial institutions regulate paper currencies’ design, printing, and circulation. For example, the Federal Reserve Board, generally known as the Fed, is the USA’s central bank regulating USD. The governments entrust the central banks to regulate production and circulation, determining the notes’ design, denominations, and security features. According to the IMF, its 189 member countries have 136 unique national currencies.

Who Guarantees the Value of Paper Currency?

Initially, paper currency was backed by commodity money (Gold and Silver); however, after 1960, this trend shifted. Currently, the USD is supported by the faith and credit of the US government. Usually, respective governments are the guarantors of paper currency. Moreover, other nations use USD as a reserve to back their currency, which is termed a Foreign Exchange Reserve.

Why Countries Do Not Print More Money?

As the value of a paper currency is highly dependent on the demand and supply of that currency, to keep the demand high, governments do not print excessive currency, which keeps the value of currency high. Secondly, printing currency leads to soaring inflation or sometimes hyperinflation, which is a sign of a bad economy, and the country’s economic infrastructure plunges into a vicious cycle of financial meltdown. For example, Zimbabwe is battling hyperinflation, with even 100 trillion dollars (Zimbabwean Dollars) in notes.

Why does Paper Currency lose its Value Over Time? Time Value of Money

Paper currency’s value loss over time is primarily due to the economic phenomenon called inflation. Inflation occurs when the general price of goods and services increases over time, leading to a decrease in the purchasing power of a currency. This effect is related to the time value of money. This concept explains how much money you have now is worth more than the same amount later.

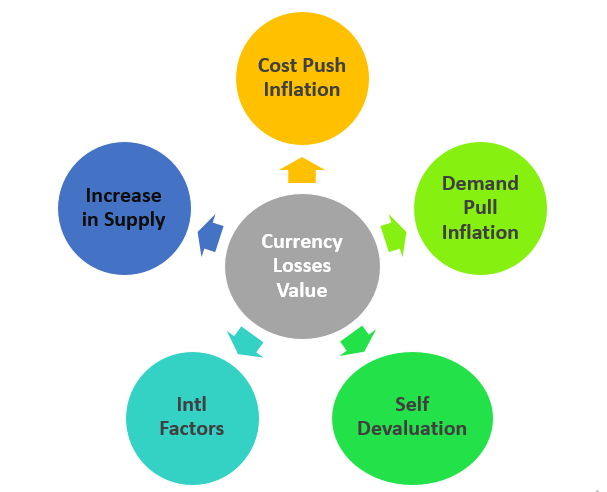

Some of the most pertinent factors responsible for paper currency’s lose in value over time are:

1. Increase in Money Supply

Oversupply can occur when the government or central bank prints more money or increases the money supply. If money grows faster than the economy grows, more money will be made from the same goods and services, leading to higher prices and lower profits. Consequently, there is a loss in the value of paper money.

2. Cost Push Inflation

Other factors, such as rising production costs (including wages, raw materials, or energy), will cause companies to increase costs to remain profitable. The increase in production costs can cause inflation and reduce the purchasing power of money.

3. Demand-Pull Inflation

When consumer demand in a business exceeds the supply of goods and services, prices will increase. Increased demand can cause suppliers to pay higher prices, leading to financial shocks and currency devaluation.

4. Self-Devaluation

The value of a paper currency is determined by the demand and supply of the currency and the economic health of the country. Sometimes, countries deliberately keep their currency devalued to get a competitive advantage for their exports and to shrink trade deficit in global trade or both.

The gradual reduction of purchasing power through inflation means that the exact amount will buy fewer goods and services in the future than now. Therefore, savings will lose value over time if interest income or return on capital does not exceed the increase in value.

5. Economic Uncertainty

Economic uncertainties include uncertainty in government policies, geopolitical events, fluctuations in financial markets, uncertainty among consumers about their future income, and global factors (international trade, exchange rates, etc.) that can harm economic activity and lead to a loss of confidence in a currency results in depreciation of the currency.

Bottom Line

In a nutshell, paper money is a widely accepted medium of exchange that facilitates economic trade and transactions within national borders and internationally. Governments issue it through their central banks, and its value and stability are essential factors for a country’s overall economic health and confidence in its financial system. No matter what, the value of paper currency decreases over time; hence, financial experts discourage people from investing in paper currency.