Ever wondered how do banks work? Banks are crucial financial institutions for the smooth functioning of the global financial ecosystem. They vary depending on the functioning and specific purpose they serve. Central banks are the state-owned banks responsible for all the country’s monetary and banking policies. Other banks work by doing business by lending and borrowing money from people or institutions and offering various financial services. They do business by providing various account types to cater to the needs of their customers from multiple backgrounds.

Most powerful currencies in the world

What is a Bank?

A bank is a financial institution that offers various services to individuals and businesses. Its fundamental objective is to take deposits from the depositors and to make loans to borrowers. Banks make money by charging higher interest rates to the borrowers than interest rates on deposits. In addition, the bank offers various services like checking accounts, saving accounts, certificates of deposits, currency exchange, efficient national and international transactions, etc. In short, banks play many functions that help facilitate stable financial transactions in a country, provide a safe financial net essential for individuals and businesses, and foster economic growth.

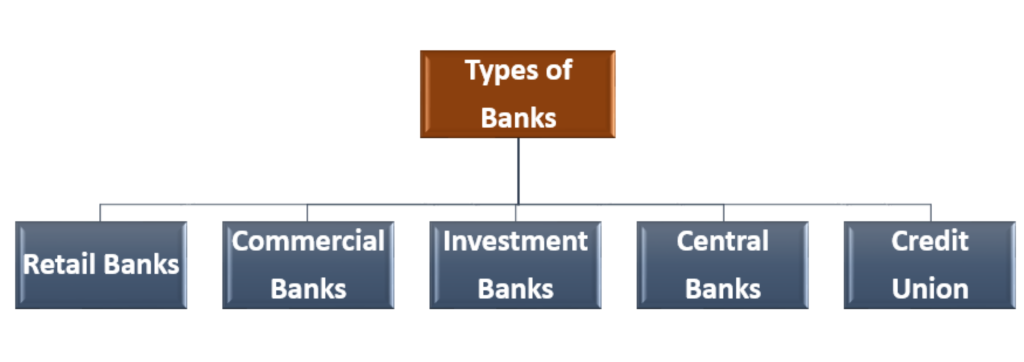

Types of Banks

Depending on the services provided by the banks, they are commonly categorized into the following five types:

1. Retail Banks

These kinds of banks offer services directly to individuals and small businesses. They aim to provide essential financial services like current accounts, saving accounts, short-term loans, mortgages, leases and various investment instruments. Retail banks are usually necessary because they help individuals equip themselves with the resources to manage their money and meet their financial goals.

2. Commercial Banks

These are the financial institutions that offer services to businesses, institutional clients, and corporations instead of individual customers. Their primary function is to provide diverse financial services to businesses. Commercial banks serve as intermediaries between depositors and borrowers.

Commercial banks receive business deposits, offer them with checking accounts, and accept short-term and long-term deposits. At the same time, commercial banks are expanding financing options in the form of loans, lines of credit, and trade finance options, which allow businesses to finance operations, expansion, and various capital expenditures.

In addition, these banks provide treasury and cash management services, help companies manage their cash flows efficiently, process foreign exchange transactions, and provide interest rate hedging solutions.

Related: What is paper currency? Why does it lose value over time?

What are Giant Commercial Banks?

Giant commercial banks have specific investment banking departments that assist them with raising capital by endorsing protections, working with consolidations and acquisitions, and giving stocks and bonds. Also, it assumes a significant role in working with worldwide exchanges by giving exchange finance administrations like letters of credit and import/trade support.

These banks likewise offer risk management arrangements, like protection and subsidiary items, to assist organizations with lessening monetary dangers connected with market changes, loan cost variances, and money chances. These banks make significant commitments to the economy, supporting organizations with economic power, warning administrations, and adaptability for financial development and strength.

Global economic outlook in 2024

3. Investment Banks

These financial institutions usually deal with high-profile companies and individuals. They primarily aim to manage stock, securities, and bond trade between investors and companies. These banks are financial service providers and act as intermediaries in complex financial transactions, i.e., they facilitate corporations to issue a share of stocks in an IPO or any other stock offering. They also play a variety of functions, such as assisting companies in capital raising and facilitating mergers and acquisitions. They also have a research division that conducts in-depth financial research to provide valuable insight into companies.

4. Central Banks

A central bank is also a financial institution responsible for managing and overseeing a country’s monetary policy, banking system, money supply control, and interest rates. It is an independent institution that acts as an apex monetary authority in a country. The Federal Reserve Board (FED) is the central bank of the United States.

5. What is a Credit Union?

Unlike traditional banks, the credit union offers banking services but is not profit-oriented. The credit union serves the best interests of its members. Its primary function is to provide financial services like saving accounts, checking accounts, loans, mortgages, etc., to its clients or members. These members usually share a common bond, like belonging to the same community or sharing the same company or a common association. Credit unions offer competitive interest rates on loans and deposits and lower fees than traditional banks.

Eight online careers from home

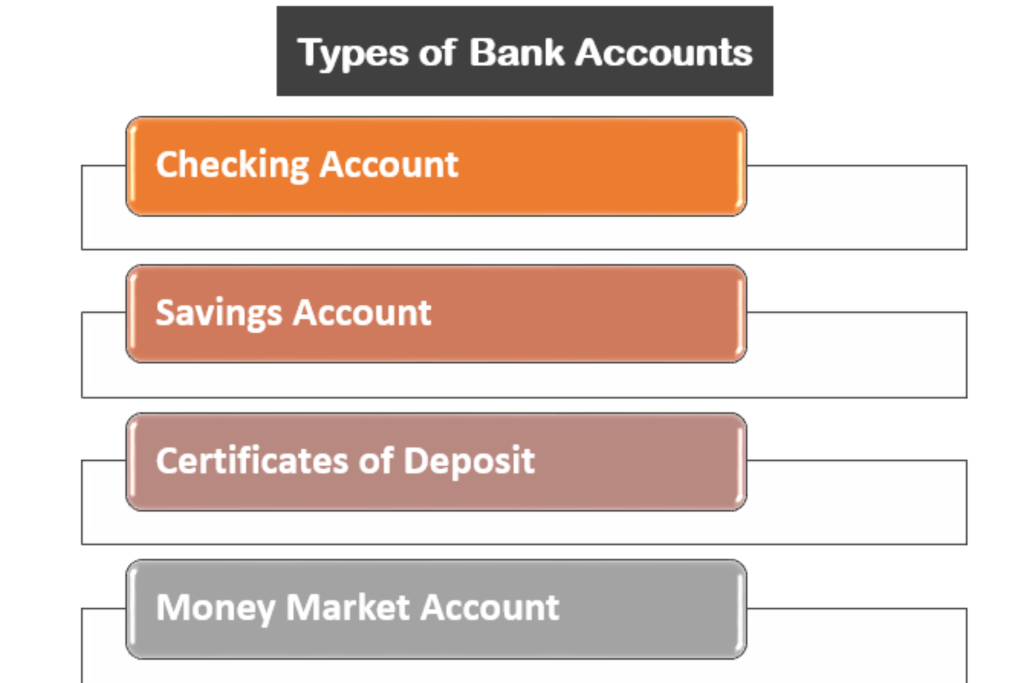

Types of Bank Accounts

Banks offer various types of bank accounts depending on the requirements of their customers. These types are broadly categorized into the below four types:

1. Checking Account

Checking accounts are accounts in which a person deposits and withdraws money quickly for daily transactions. Its primary purpose is to hold cash in a secure place for routine financial activities to available funds when individuals need it to pay bills and other expenses.

2. Savings Account

These are the types of accounts that allow individuals to deposit money and earn interest rates on their deposits. It serves as a secure platform to store funds while enabling account holders to grow their money over time. They are used for long-term objectives like home buying, education expenses, etc.

3. Certificates of Deposit

These are time deposits that pay interest for a predetermined period. These are considered low-risk investments and provide higher interest rates than other deposit accounts. These accounts offer high interest only upon the completion of the term. On the other hand, the account holder gets penalized for early withdrawal.

4. Money Market Account

Money market accounts offer features of both savings and checking accounts. They also offer higher interest rates and limited check-writing ability. A minimum balance is required to open such accounts. The minimum balance requirement varies depending on the institution.

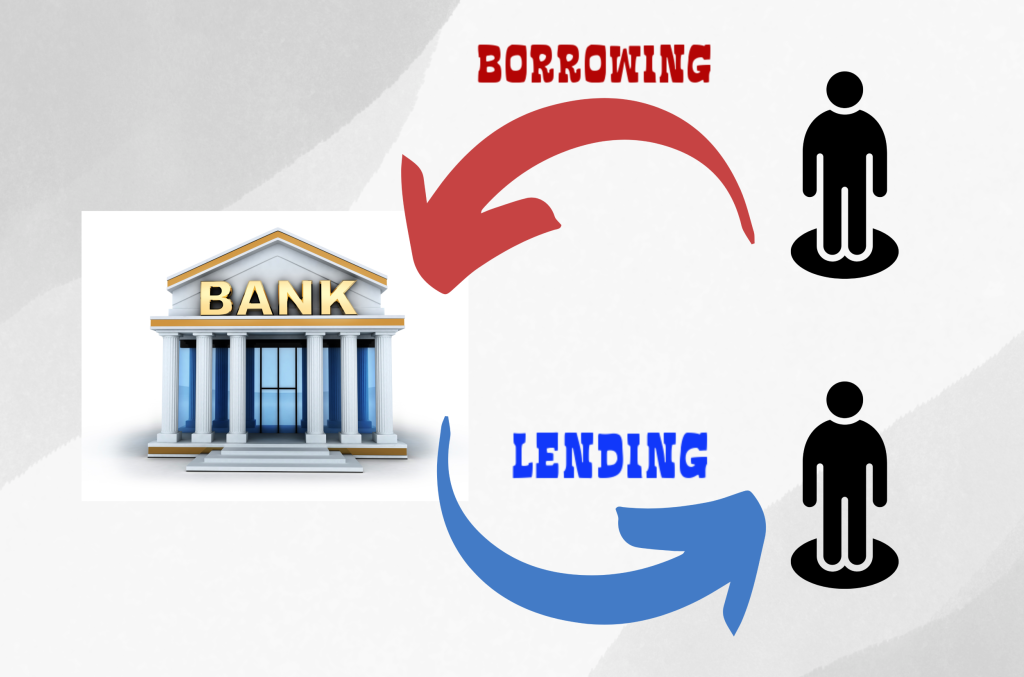

How do banks work?

Banks are financial institutions that play an essential role in an economy by facilitating money flow and providing various financial services. Banks work on the fundamental principle of deposit-taking and lending. Banks take deposits from customers and then utilize these deposits to make loans; in between, they profit by charging interest rates, and banks reserve some funds in their reserve accounts, which serve as a safety net.

1. Offering Loans/Lending

Banks offer loans in various ways, like personal loans, business loans, mortgages, credit lines, etc. The interest charged on these loans constitutes a significant source of income for banks. Loans are granted based on creditworthiness assessments, where banks evaluate the borrower’s financial history, income, collateral, and other factors to determine the risk associated with lending.

2. Providing Financial Services

Apart from lending, banks also perform various financial services like saving and checking accounts, certificates of deposits, mutual funds, foreign exchange services, and other wealth management services. These services also help to deal with the financial requirements of individuals, businesses, and institutions.

3. Payment Systems

Banks also play a crucial role in the payment system. They facilitate domestic and international transactions through various channels, such as electronic money transfers, wire transfers, checks, and credit/debit card transactions. The infrastructure and networks created by banks ensure the quality and security of money transfers between bankers and businesses.

5. Risk Management

Risk management is also vital banking operation. Banks encounter various risks, such as market, credit, and operational and regulatory risks. Banks employ risk management strategies like diversification and setting aside reserves to meet these risks. The interconnection between banks in the financial system emphasizes the importance of security. Financial problems can have far-reaching consequences on an individual bank and the entire economy. Therefore, central banks often act as lenders of last resort, providing income to banks to prevent significant financial losses in times of crisis.

Bottom Line

Banks operate as critical financial intermediaries, transferring money from savers to borrowers, providing essential financial services, promoting businesses, risk management, and regulatory compliance. Banks work on the core principle of borrowing and lending money as an intermediary. Their multiple roles impact economic growth, stability, and the overall health of individuals and companies across the global financial ecosystem.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.