The United Nations has issued its Report on World Economic Situation and Prospects for 2024. The global economy did well in 2023 despite huge inflation, strict monetary policy, conflicts worldwide, and the worst climate change disasters. However, the global economy is not showing promising prospects in 2024.

In 2023, the global GDP growth was 2.7%, projected to be 2.4% in 2024. This projection is due to further escalations in conflicts in the Middle East, disrupting the energy market and inflationary pressures. Some other reasons for this slower GDP growth are increased interest rates for a longer time by developed countries; geopolitical fragmentation and tight financial conditions pose a significant risk for global GDP growth. Above all, unattended global warming poses a much graver threat to the global economy in 2024 and for years.

Outlook of Regions Contributing to Global Economy

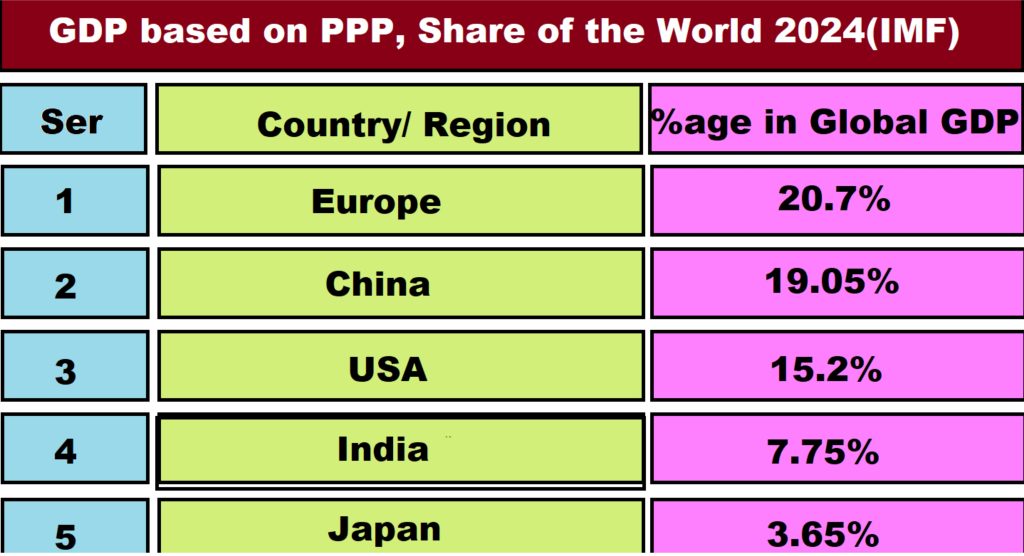

The global economy is the sum of all the economies of the world. The economic outlooks of vital contributors to the global economy are explained below:

1. Economic Outlook of USA

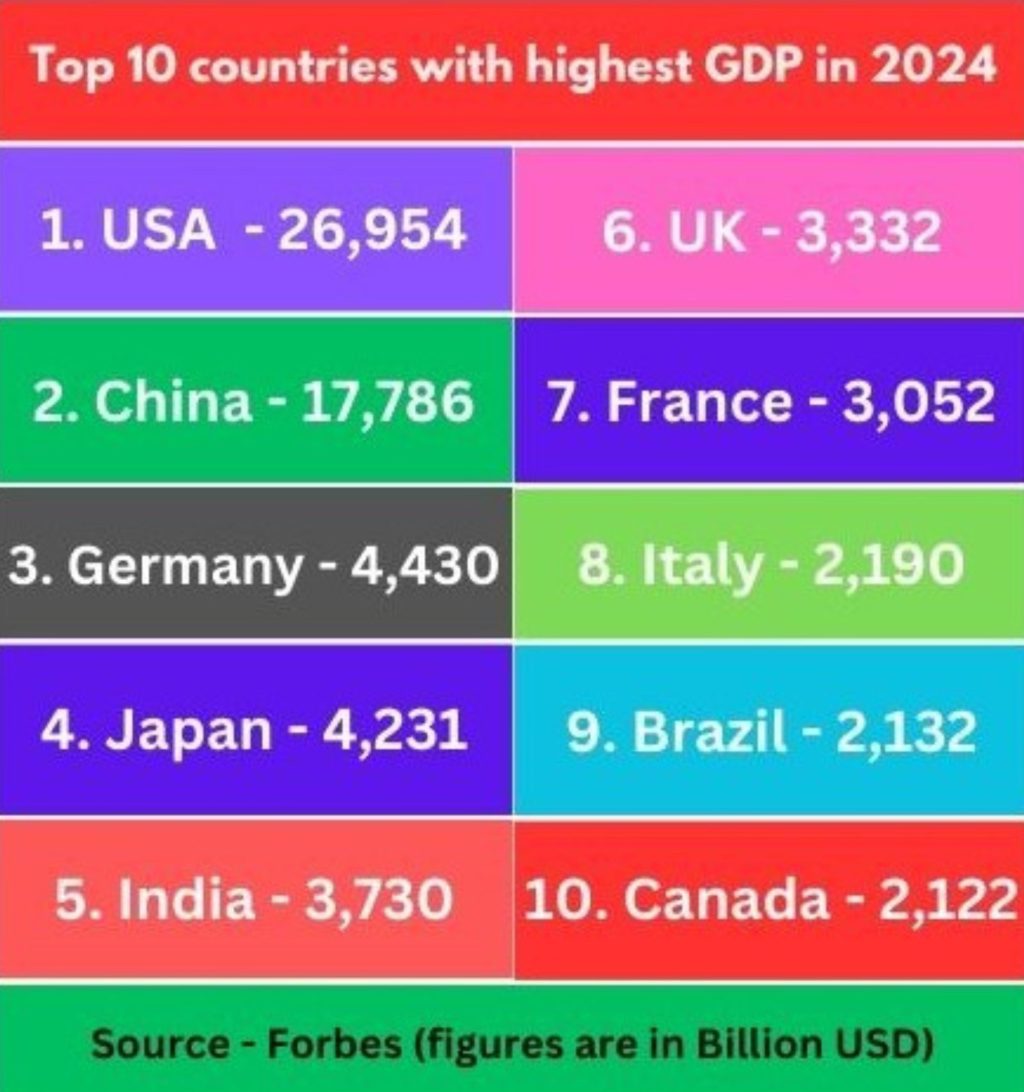

Despite being the largest economy in the world, the growth of the USA is projected to decelerate from 2.5% in the year 2023 to 1.7% in 2024. The factors posing risks to the largest global economy are consumer spending projected to be weakened, high interest rates, and a decline in the labor market. Worsening of housing and financial markets and a fall in household savings may further exacerbate the situation. The investment in 2024 is estimated to remain sluggish in the USA. The USA is the biggest contributor to the global economy; such economic changes are felt globally.

What is money? Its characteristics and features

2. The Europe

Being the largest trading bloc, the European economy plays a vital role in the global economy. The GDP growth rate in the European economy is expected to increase by 1.2% in 2024 from 0.5% in 2023. This growth is estimated to be driven by increased consumer spending, a strong labor market, and an increase in real wages. Though the growth is expected to increase in European countries, tight financial conditions and a lack of fiscal support might offset this increase.

3. The China

The importance of China’s economy to the world cannot be ignored, as China is the largest exporter of goods in the world. So, China’s economic growth strongly correlates with global economic growth. The Chinese economy did well in the second half of 2023, with a growth rate of 5.3%, up from 3.0% in 2022. But, it is projected that the growth of China will slow down to 4.7% in 2024. This decline will occur mainly due to weakness in the property sector and servile external demand. These factors will negatively affect exports, industrial production, and fixed exports.

4. Japan

It is projected that Japan will also face a decline in growth despite having complaisant fiscal and monetary measures. It is estimated that the growth of Japan will decline to 1.2% in 2024 from 1.7% in 2023. This is mainly due to inflationary pressures and the slow growth of Japan’s main trade partners like China and the USA (the slow growth of China and the USA will affect Japan’s net exports).

5. Common Wealth Independent States

High Economic growth in common-wealth independent states is projected. Higher growth is estimated in the Russian Federation, a moderate recovery in Ukraine after the worst growth in 2022, and strong growth is projected in the Caucasus and Central Asian regions. The average GDP was 3.3% in the year 2023. It is estimated to grow by 2.3% in 2024. Moreover, inflationary pressure and tightening monetary policy in the Russian Federation may negatively impact overall regional growth in 2024.

How to achieve financial freedom?

6. The Africa

The growth in Africa will remain sluggish, estimated to increase from 3.3% in 2023 to 3.5% in 2024. The driving forces for this mild increase in growth will be tight fiscal and monetary measures, global economic downturn, high debt, and extreme climatic conditions. Most importantly, geopolitical instability coupled with extreme weather events might pose a difficulty in the economic recovery of African countries.

8. The East Asia

The East Asian economies will experience a minor slowdown in their growth. Economic growth in these regions is projected to decline from 4.9% in 2023 to 4.6% in 2024. Most East Asian economies are estimated to experience private consumption growth, ease of inflationary pressure, and recovery in the labor market, but the slowdown of global demand will negatively affect merchandised exports, as exports are a major driver of growth for most economies in this region.

9. The South Asia

Economic growth of the South Asian region is estimated to grow by 5.2% in 2024; previously, in 2023, it grew by 5.3%. The major growth pulling factor in the South Asian region is the rapid expansion of the Indian economy. Still, in 2024, the Indian economy will also face a slight decline in growth from 6.3% in 2023 to 6.2% in 2024. Many other economies in this region will face a downward growth trend, primarily due to the balance of payment, debt, climate, and tighter fiscal and monetary measures.

10. The Western Asia

Western Asia is expected to face lesser inflationary pressures. The region is expected to grow by 2.9% in 2024 from 1.7% in 2023. Inflationary pressures may decline gradually by the end of the year. However, tightening the monetary policy to mitigate inflation in Turkey might restrict growth in 2024.

11. Latin America and The Caribbean

The year 2024 will be a challenging year for these regions. The growth in these regions is estimated to slow down from 2.2% in 2023 to 1.6% in 2024. This is due to several factors, such as inflationary pressures, tighter financial conditions, and structural and macroeconomic policy challenges. Moreover, slower growth of major economies like the USA and China will have a negative impact on these regions.

12. Least Developed Countries (LDCs)

The least developed countries are estimated to grow by 5.5% in 2024 from 4.4% in 2023. They still lag behind the 7.0% growth target set by SDGs. Most LDCs are commodity-dependent economies. Additionally, they depend on industry-dominated countries to fulfill national requirements, so any economic fluctuation in industrial countries trickles down to impact LDCs. Hence, volatile commodity prices coupled with low investments and external debts may negatively affect the growth of these countries.

How to improve fundamental analysis for trading?

13. Small-Island Developing States

The small island developing countries are estimated to grow 3.1% in 2024 from 2.3% in 2023. These countries depend on tourism for their growth. These countries have faced economic crunches during the COVID-19 pandemic but largely recovered from it in 2022 and 2023. They will remain vulnerable to climatic conditions and fluctuations in commodity prices. But, the outlook of these countries for 2024 is largely positive.

Related: Economic impacts of Climate Change – A case study

14. Land-locked Developing Countries

According to the UN report, land-locked developing countries are expected to experience a slight improvement in growth rate, from 4.4% in 2023 to 4.7% in 2024. This is largely driven by foreign direct investment, particularly in infrastructure development.

Bottom line

In 2024, the global economy will face a decline in overall GDP growth. There will be many factors complementing this downward trend. The biggest factor is the slowdown of the economic growth of the top two contributors (USA and China) to the global economy. Other factors include hikes in interest rates, inflationary pressures, tighter monetary policies by central banks, and geopolitical instability. These factors and climate disasters may impede global economic growth in 2024.

[…] How global economy will react in 2024? […]

[…] How will the global economy act in 2024? Read here… […]

[…] How Global economy is going to act in 2024? Read here… […]

[…] Related: How global economy is going to act in 2024? […]

[…] How global economy is going to respond in 2024? […]

[…] How global economy is going to act in 2024? […]

[…] Global economic outlook in 2024 […]

[…] Related: Global economic prospects in 2024 […]

[…] How global economy is going to act in 2024? […]

vAyEzaSFoslkI

[…] Related: How global economy is going to act in 2024? […]