Many online earning enthusiasts are eager to start their journey in forex trading. According to the Triennial Central Bank Survey of Foreign Exchange, 2019 crypto market has the highest trading volume (more than 6.6 trillion dollars). Moreover, to capitalize on such a vast marketplace, one has to be well-equipped about concepts related to it. Some basic concepts of forex trading: what is forex, what is forex trading, its types, essential graphs used in forex trading, and some fundamental terminologies will be discussed in the article.

Understand what is Forex and Forex Trading?

Forex is a combination of two words “Foreign” and “Exchange“. Currencies of different nations are exchanged for business, tourism, etc in forex. It has been traded to earn profits for centuries. A marketplace has been created where forex is traded by people, banks, and other financial institutions around the globe in the current globalized world. Forex trading is gaining popularity primarily because of the boom of electronic brokers. These brokers ensured the participation of common people in this marketplace which was done by firms in the past. Forex market works almost 24 hrs. a day. It is a decentralized market run and controlled by networks and computers.

What are The Types of Forex Trading?

Although there are many strategies used for forex trading but there are four main types of forex trading in practice, which are: Day Trading, Swing Trading, Position Trading, and Scalping.

Day Trading

Day trading is a technique where a trader is involved in a trading activity (completes his trade) before the closure of the market on that day. This technique requires more focus on the technical aspects of graphs rather than focusing on long-term fundamental analysis. Trades are required to have patience about entry and exit points. This type of trading involves higher volumes (bigger lot sizes) and depends on volatile currency pairs to earn a good profit.

Related: How to learn technical analysis?

Swing Trading

Swing trading focuses on longer and broader movements of the market/graph. Traders need to hold their trade for longer periods usually for days or weeks. Traders must have a strong fundamental analysis of the market and a technical analysis of graphs (resistance and support). Generally, traders use lesser trade volume (smaller lot sizes) and prefer a less volatile market. Entry and exit points play an important role.

Position Trading

It is the opposite of day trading, traders hold their position (entry point) for longer periods (usually months and years). In this type of trading, smaller lot sizes are used to avoid risk. Technical analysis is of less importance, whereas a strong fundamental analysis of the global economic outlook is very important. Mostly financial institutions like Banks and investment companies are involved in this type of trading.

How psychology impacts forex trading?

Scalping

This is not technically a recognized trading strategy rather it is a much shorter form of day trading. Strong technical analysis as well as knowledge about entry and exit points play a very crucial role. It is a high-risk high-gain technique and generally avoided by traders when the market is too volatile. The majority of new traders unknowingly exercise this technique as they are not aware of entry-exit points and graph movements, and end up losing money.

Which Types of Chats Are Used in Forex Trading?

There are three types of charts used in forex trading: Candlestick charts, Bar charts, and Line charts.

Candlestick Chart

The bars in this graph are most important in forex trading. Candlestick bars carry maximum information about the trend. Bars in this chart are colored red or green. The green bars show an upward trend and the red bar shows a downward trend. Candlesticks also carry information about opening and closing points in that specific period. The Wick of the candlestick bar shows the maximum and minimum points of the bar in that period.

Bar Chart

As its name represents, bars are used to represent the information of that specific period. Bar graphs and candlestick graphs give usually the same information but in a different way. A bar in the graph contains data about a certain period (say for instance; a day). Bullish and bearish bars are color-coded with opposite colors (red and green or white and black). The only difference between a bar graph and a candlestick graph is: bar graphs represent opening and closing in different ways. A dash on the left of a bar represents the opening whereas the closing is represented by a dash on the right side.

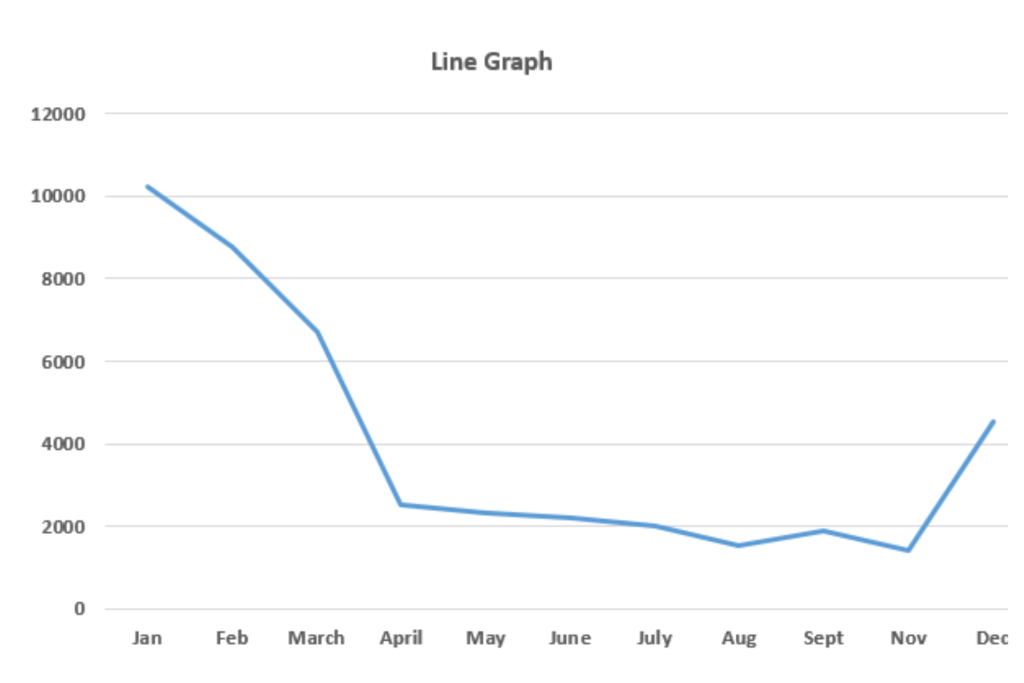

Line Graph

A line chart or line graph is a linear continuous graph connecting all the closing points in the chart. Line charts are used to understand larger and broader trends. As it is drawn by continuously connecting all the closing points, it gives much more insight into future trends. It removes all unwanted noise and saves a lot of time and energy for the trader. Moreover, Line charts are also very helpful in understanding resistance and support ranges.

Some Important Concepts about Forex Trading

Let’s discuss some of the important concepts of forex trading in simple layman’s words.

Leverage

All the brokers offer high leverage. Leverage allows trades to open larger positions than his actual amount allows. For example, if a trader sets leverage size 200:1, and has only a hundred dollars in his account then this leverage allows the trader to open a position of 20,000 dollars.

Spread

Spread can be seen on the graph, it is the same for all the currency pairs except in pairs where the Japanese Yen is involved, the larger the spread the more you see loss when you place a trade. So, always position your trade when the broker offers less spread.

Pip

When you start trading, you will come across this term very often. Pips with lot size are used to calculate profit or loss in a trade. Pip is the smallest size of a currency pair which can move up or down.

Resistance

Knowledge of resistance levels is important for identifying entry and exit from a trade. A resistance level is measured from previous highs of the market. Resistance is the range, where the graph finds it hard to move further up, so it provides an important entry point for selling.

Support

It is recommended that if you want to enter into buying, support provides you the ideal entry point. Support range is measured using previous lows, just opposite to what resistance is. It is the range from where the graph has very low chances of going further down and high chances of retracement or moving up.

Lot

In simple words it is the risk you are taking for the trade, if your lot size is high you earn/lose more and if your lot size is low you earn/lose less. Lot size is very important for risk management. Just remember, if you open a trade with a lot size of 1 lot, a single Pip value will be 10 dollars.

Bottom Line

Forex trading is a vast field; this is a beginner’s guide covering what you need to know before forex trading. Some basic concepts about forex trading are covered here, keep following us to learn more.

FAQs

What knowledge is required for Forex trading?

To begin your journey, some basic terminologies like Pips, Spread, Support, Resistance, etc are very important. Furthermore, knowledge about chart reading and mathematics about charts is also necessary. It can be learned while practicing forex trading on demo accounts. Moreover, a decent level of understanding of global events will help a lot in fundamental analysis.

What are the basics of forex trading?

Forex trading basics include the nature and platforms used for it; types of forex trading; different charts used in forex trading and core concepts/ jargon related to forex trading like Pips, Spread, support, resistance, and lot size.

Is 100 $ enough for forex trading?

As far as whether you are allowed to start forex trading with a 100$ is concerned then the answer is Yes. But if you are asking about making good profits from a 100$ investment is concerned then the answer depends upon how good you are at trading. If you are a beginner then it is not recommended to start with 100 $.

How to master forex?

Fundamental and Technical analysis are two major aspects to master forex trading. You can improve your analyses with a broad study of factors involved in technical and fundamental analyses and repetitive practice of your conclusions from your analyses.

Best of Luck!

[…] I […]

[…] is unique in himself and has different mental state and emotional aspects. Individual psychology in forex trading plays a crucial role. Taking care of these psychological aspects in trading is the second most […]

[…] What you to know before starting forex trading. […]

[…] you are interested in day trading or scalping, developing your ability to think quickly and confidently make decisions is essential. Technical […]

[…] Understand what is forex trading… […]

[…] it comes to Forex Trading, timing can be everything. The Forex market is open round the clock, allowing traders to make […]

[…] to another currency. The U.S. dollar stands at the 10th position in this tool of measurement. In forex trading, the relative values of currency are joined together to form currency pairs (for example, […]

[…] Forex is a marketplace where national currencies are traded in currency pairs (EUR/USD, USD/JPY, etc). It is an old profession, so why is it included in this article? The answer is the evolution of the internet and online trading platforms, which made ordinary people’s access to the forex market easy. These platforms are readily available, and one can be part of this marketplace by completing the simple registration steps. Conventionally, forex trading was carried out by financial institutions, and ordinary people could only participate through mediatory (traditional brokerages). Still, everyone can now trade forex on platforms like OctaFx, Exness, and hundreds of others. […]

[…] the “buy and hold” strategy. This strategy is practiced in all investment markets (stock bonds, forex, etc.), but it is best suited for the real estate and commodity markets, especially the precious […]