Forex trading is one of the biggest marketplaces in terms of liquidity. International currencies are traded as currency pairs in the forex market, as national currencies do not have any intrinsic value. That is why forex is traded as currency pairs like EURUSD, GBPJPY, etc. Moreover, understanding currency pairs is crucial for a successful trading journey. These currency pairs have been subcategorized into majors, minors (exotics), and crosses. Among these categories, majors are considered the best currency pairs to trade, and crosses are considered the second best currency pairs to trade in forex.

Related: What is paper currency and what is the time value of money?

Why Currency Pairs Are Used?

The Forex market uses currency pairs for trading. The need for currency pairs arises because of two primary reasons.

- First is the nature of the forex, as forex is a combination of two words, “Foreign” and “Exchange”, and exchange always occurs between two entities. In forex trading, traders cannot just buy and hold a currency. Instead, they have to exchange it with another. For example, if a trader is buying GBP/JPY, he is buying GBP, and at the same time, he is automatically selling JPY.

- The second reason for using currency pairs is that currencies generally do not have any intrinsic value. Instead, they are always valued relative to each other, and most currencies are valued against the US dollar. So, it becomes imperative to create pairs for smooth forex trading.

Related: Understand how exchange rates are decided?

Understand a Currency Pair

Understanding a currency pair is essential for successful trading. A currency pair is a combination of two currencies; one is termed the base currency, and the other is the quote currency. For example, in the case of GBP/JPY, the numerator “GBP” is the base currency and the denominator “JPY” is the quote currency. Sometimes, currency pairs are denoted just by joining their acronyms like EURUSD and GBPJP; in this case, the first currency is the base currency, and the second currency is the quote currency.

Explore these 8 online careers from home

How does psychology play a crucial role in the forex trading journey?

What is money? Its characteristics and types

Understand the Buying and Selling of a Currency Pair

When a trader buys a currency pair, he hopes the base currency gets stronger, the quote currency gets weaker, or both simultaneously. For example, in the case of GBP/JPY, a trader hopes to get the GBP stronger or JPY to get weaker to make a profit.

In the case of selling, a trader hopes that the base currency will weaken, the quote currency will get stronger or both. It is 180, which is the opposite of buying a currency pair.

How does psychology play a crucial role in the forex trading journey?

Categories of Currency Pairs

Currency pairs are further categorized into Major, Minor(Exotic), and Cross-currency pairs.

1. Majors

Major currency pairs involve currencies of developed countries and usually involve USD. These are the best currency pairs to trade and carry high trade volumes and liquidity. For example, EUR/USD, GBP/USD, USD/CHF, etc.

2. Minors/ Exotics

These are the currency pairs which involve the currency of a developed country, mostly USD, and that of a less developed or developing country. These pairs carry the least trading volume and liquidity. This category is the least traded one. For example, USD/BRL and USD/ZAR.

Instances when forex trading should be avoided

3. Crosses

These are currency pairs that do not involve USD. They include currencies from other major countries like GBP, EUR, etc. Crosses show good liquidity and trading volume but less than the majors. For example, GBP/JPY, EUR/JPY, etc.

Why do Traders Prefer Popular Currency Pairs?

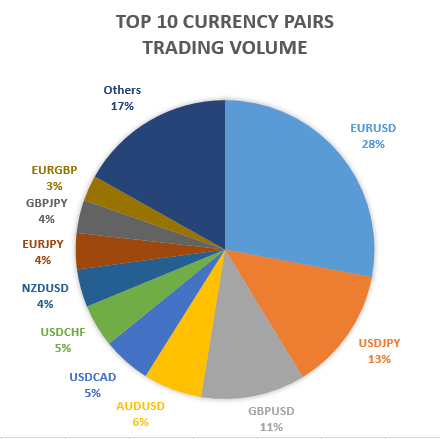

EUR/USD single-handedly carries more than 27% of trading volume; carrying such a high volume indicates that most forex traders prefer EUR/USD. So many traders prefer trading only EUR/USD for several reasons.

- First and foremost, famous or actively traded currency pairs have high liquidity, which is suitable for traders.

- Actively traded currencies offer lower spreads and lower volatility. Low spread and lower volatility are favorable trading conditions for an asset.

Understand crucial trading charts for trading

Best Currency Pairs to Trade

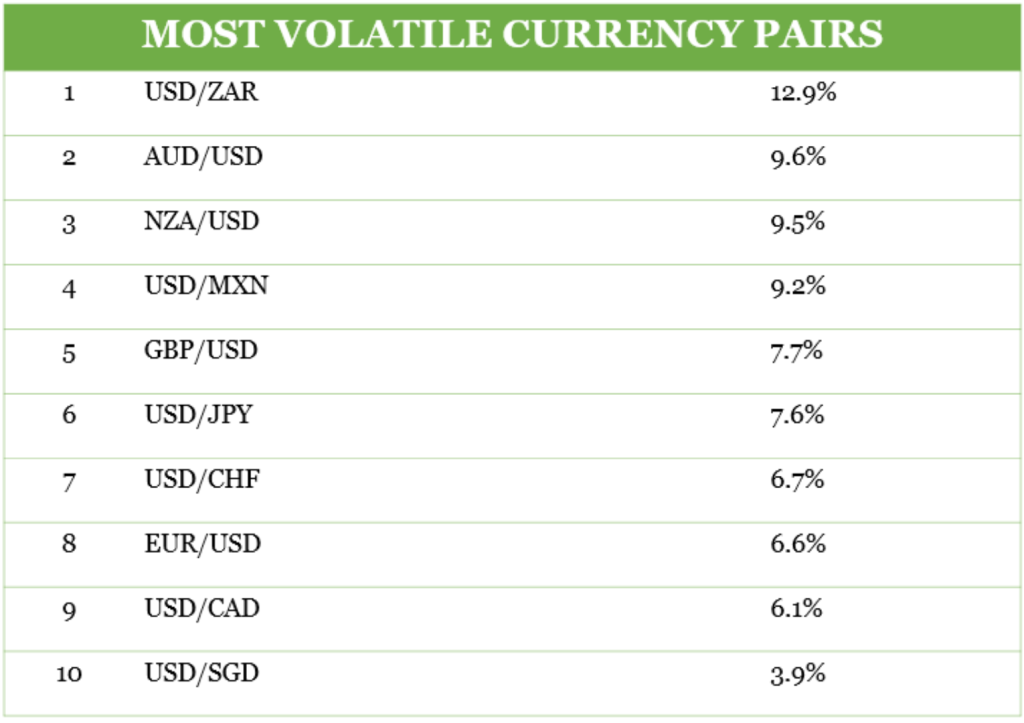

Various factors can be considered to gauge the best currency pairs; however, the most critical factor is trading volume. Over 60% of currency pairs involve USD, and 7 out of 10 most traded currency pairs involve USD as the base or quote currency. Following are the ten best currency pairs to trade in forex:

1. EUR/USD

EUR/USD is the forex market’s most traded major currency pair. This pair uses the Euro as the base currency and the USD as the quote currency. It is the best currency to trade, carrying a trading volume of 27.95%. It has shown that the average 30-day realized volatility in the last three years is 6.6%.

How to learn technical analysis skills for trading

2. USD/JPY

USD/JPY is among the best currency pairs to trade in the forex market. This pair is created by putting USD as the base currency and JPY (Japanese Yen) as the quote currency. It carries the second-highest trading volume of 13.34% and an average volatility of 7.6% over the last three years.

3. GBP/USD

It has the third-largest trading volume of 11.27% and an average volatility of 7.7% over the last three years. GBP (British Pound) is the base currency, and USD is the quote currency. Keeping track of reports related to the economy of UK and US is crucial to understand this pair.

How to improve fundamental analysis skills

4. AUD/USD

This currency pair is the first to have below 10% of trading volume, 6.37%. It is the second most volatile pair, with a 9.6% average volatility over the last three years. AUD (Australian Dollar) is the base currency, and USD is the quote currency.

5. USD/CAD

USD/CAD has the fifth largest trading volume, 5.22%. It is the ninth most volatile currency pair, with an average volatility of 6.1% over the last three years. USD is the base currency, and CAD (Canadian Dollar) is the quote currency.

Understand various investment markets

6. USD/CHF

USDCHF is the sixth most traded currency pair. Trading in this currency pair offers diversification, high liquidity and volatility. The pair carries a trading volume of 4.63% and a three-year average volatility of 6.7%. CHF (Swiss Franc) is the currency quoted for this pair.

7. NZD/USD

The seventh most traded currency pair is the NZD (New Zealand) dollar paired with USD. Its trading volume is 4.08%. Factors affecting this currency pair include the difference in interest rates between the Reserve Bank of New Zealand and the US Federal Reserve (Fed), geopolitical events, market sentiments, etc.

How is the global economy going to act in 2024?

8. EUR/JPY

It’s a currency pair falls under the category of crosses, i.e. a most popular currency pair not associated with USD. The eighth most traded currency pair is EUR currency (the base currency) paired with JPY (the quote currency). The trading volume of this pair is 3.93%.

9. GBP/JPY

The British currency is the fourth most traded currency, and JPY is the third most traded currency globally; hence, pairing these countries’ currencies results in a very liquid and popular currency pair. The trading volume of this pair is 3.57%.

10 biggest stock exchanges in the world

10. EUR/GBP

This currency pair represents a pairing between two of the world’s largest economies, the United Kingdom and the Eurozone. It is also a stable pair, possessing high liquidity and great trading opportunities. The trading volume of this pair is 2.78%.

Bottom Line

Forex trading uses currency pairs, which have been sub-categorized into majors, minors, and crosses. To identify the best currency pairs to trade, a trader has to understand various aspects of currency pairs, especially category, volatility and liquidity. Considering these factors, EUR/USD and USD/JPY are the two best currencies to trade.