Student loan forgiveness is becoming a critical topic in the financial landscape of the United States. According to the Federal Reserve Board, cumulative student debt has ballooned over $1.72 trillion till 2024. Although the debt has declined for the first time, this pressing issue still needs much attention from the government, financial institutions, and especially students. Over 45.7 million individuals are affected by student loans; surprisingly, 2.4 million are over 62 years old and owe $98 billion to lenders.

Related: Debt Management Strategies

Student loans are offered across all countries to encourage students to pursue/ complete education. These loans usually come with some relief or subsidy from the government. Since students cannot earn enough to cover the expenses of their education and loan installments, it ultimately becomes a heavy financial burden for millions of students.

The concept of student loan forgiveness aims to ease the pressure from borrower students and focuses on the efforts to eliminate or reduce the debt. In this article, we will focus on history, current programs, eligibility criteria, and the steps involved in securing student loan waivers so that these individuals liberate themselves from a vicious cycle of debt.

Understand the importance of Emergency Funds

A Brief History of Student Loan Forgiveness

The concept of student loan forgiveness has been there for decades. The first such policy was introduced in 2007 under the Public Service Loan Forgiveness (PSLF) program to ease the debt burden on students. The program was aimed at presenting a scheme to indebted individuals to lend their services in public sector jobs by offering loan forgiveness after 120 qualifying payments. In PSLF, individuals were offered a loan waiver if they successfully met the requirements after 120 payments. However, the program faced setbacks because of unclear rules and high denial rates.

Moreover, over the years, many such programs have been introduced. The first focus on students/ educators is the Teacher Loan Forgiveness program. This program provides opportunities for teachers of low-income educational institutes. The upper limit that can be forgiven is 17500 dollars taken from Federal Direct or Federal Family Education Loan (FFEL) Program loans.

Understand how to invest in Dividend Stocks

Income-Driven Repayment (IDR) program is another student loan forgiveness platform. This facility is extended, including Federal Direct Federal Family Education Loans (FFEL) and Perkins Loans. The eligibility criteria and terms and conditions for availing this opportunity are softer than the other two mentioned above, making them more affordable for borrowers. The central concept is to focus on the discretionary income, typically 10% to 15% for 20 to 25 years.

Organizations that are Responsible for Student Loan Waivers in the US

Federal organizations generally extend student loan forgiveness programs. Knowledge of such organizations will lead you to make a better approach with high chances of approvals for loan waivers. The following are primary institutions which offer such facilities:

1. U.S Department of Education

The US Department of Education (ED) is the primary organization responsible for managing and regulating federal student loans. It manages the management and implementation of various student loan forgiveness programs offered by different organizations by providing guidelines and policies.

How do people achieve Financial Freedom?

2. Federal Student Aid (FSA)

FSA is a subsidiary organization within the Department of Education. It is directly responsible for administering federal loan and aid programs for students. It tracks/records and administers loan forgiveness programs and provides support in various forms for the borrowers.

3. State-Based Programs

Almost all states run their local student forgiveness programs. One has to do some research to identify and reach out to them. Generally, these programs are also administered by state education departments.

4. US Department of Defense

The Department of Defense also provides student loan forgiveness programs for indebted students in return for their services in defense.

5. Private Loan Servicers

The US Department of Education has enlisted some companies to provide loan services to aspiring students. These companies play a crucial role during borrowing and loan forgiveness programs.

What is Money? Its types and Characteristics

Qualification Requirements of Student Loan Forgiveness Programs

Various loan forgiveness programs come with different requirements and terms and conditions. This article will discuss only the major requirements of common programs.

1. Public Service Loan Forgiveness PSLF

This is by far the most common loan forgiveness program in the US. The foremost requirement of this program is full-time employment in any public service organization. The following are some critical requirements for this program.

- As mentioned above, work full-time in any public service.

- Only direct loans are eligible; however, if someone has other types of loans, he must merge them into a Direct Consolidation Loan for qualification.

- A borrower has to complete a minimum of 120 monthly qualifying repayments staying in public service for qualification.

- Annual submission of an Employment Certification Form (ECF) to keep track of one’s progress is a mandatory step.

Note: After completing the mandatory steps, a borrower can submit a PSLF application to waive the remaining loan.

Explore these 8 online careers from home

2. Income-Driven Repayment Plans

IDR plans are more flexible than PSLF plans as they focus on income and family size. These plans include Pay As You Earn (PAYE), Income Contingent Repayment (ICR), etc. In IDR plans, a borrower pays instalments for typically 20-25 years and the rest of the loan is forgiven. The following are the core requirements for most IDR plans:

- A borrower must only have federal student loans like Direct Loans, FFEL, or Perkins Loans.

- Defining discretionary income that is the difference between adjusted gross income and 150% of the poverty guideline according to a borrower’s family size and residence.

- Annual recertification of your income to provide updated data about discretionary income is mandatory to stay on an IDR plan. Changes in a borrower’s income lead to changes in payment amount.

There will be many other terms and conditions. Once the terms are met, a borrower can apply for loan forgiveness.

Understand various aspects of Financial Literacy.

3. Teacher Loan Forgiveness Program

This program is extended to teachers who work in low-income schools. A teacher who has worked for at least five years in such a school is eligible for this program. The upper limit for this program is 17,500 USD. However, the following are some critical requirements for availing of this program:

- One must have employment for a five-year continuous full-time job in a low-income elementary or secondary school or any other educational institute.

- The institution where the borrower is working must be enlisted in the Department of Education’s designated low-income schools.

- Only direct federal and FFEL loans are eligible; a borrower must not default on the loan he applies for forgiveness.

- Applicants for this program must be certified/licensed teachers by the state administration.

After successfully going through all the requirements, a borrower can move an application for loan forgiveness.

Understand the workings of Banks

Procedure to Get Student Loan Forgiveness

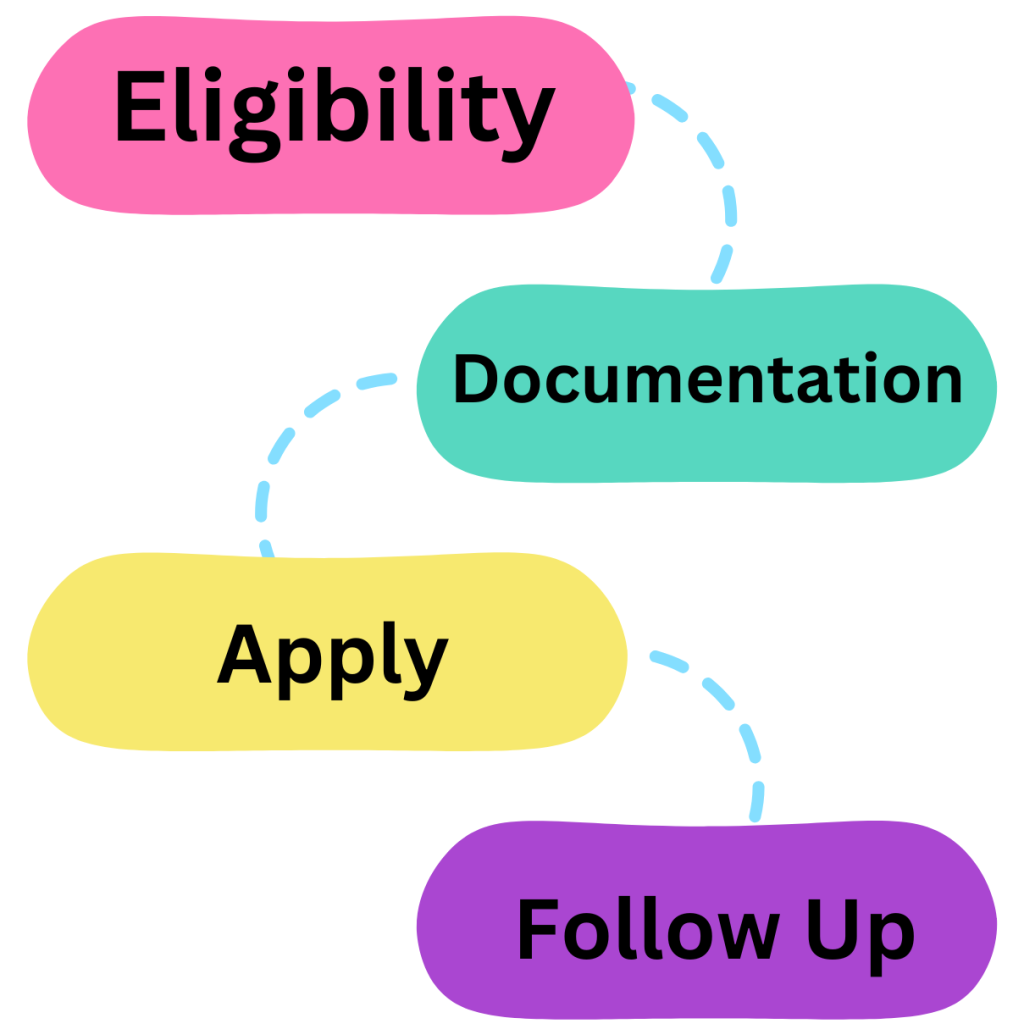

The process of applying for various student loan forgiveness programs varies by program. However, a general overview of the process involves the following steps:

1. Determining Eligibility

As terms and conditions differ for every program, determining which loans a person is eligible for is crucial. The wrong selection of a forgiveness program always leads to disqualification and complications for forthcoming programs.

2. Complete the Requisite Documentations

Documentation is the next crucial step. All the required documents must be acquired or arranged as and when required. Some programs may need employment history; some may need payment history. So, a checklist of required documents will be helpful.

Explore these Investment Markets

3. Submission of Application

After successfully arranging all the requisite documents and confirmation of eligibility, a borrower can submit a formal application to kick-start the official loan forgiveness process. This step may require some extra documentation, forms, etc.

4. Follow Up

After applying, one has to maintain a connection with the loan service provider. Keeping track of everything related to forgiveness. A need may arise where the service provider may need something from the borrower.

How Global Economy is going to act in 2024?

Bottom Line

The concept of student loan forgiveness has emerged due to mounting student debts. Millions of individuals across the US need help paying their education loans even after decades. Loan forgiveness schemes have been introduced to provide ease for such loans. The first such scheme (PSLF) was introduced in 2007. Since then, more schemes have come to the forefront, targeting individuals from various backgrounds and jobs. This variety led to setting up different requirements and terms and conditions for availing such an opportunity. This article gives a brief guideline about the nature of such programs, organizations affiliated with these programs, and guidelines for aspiring individuals.